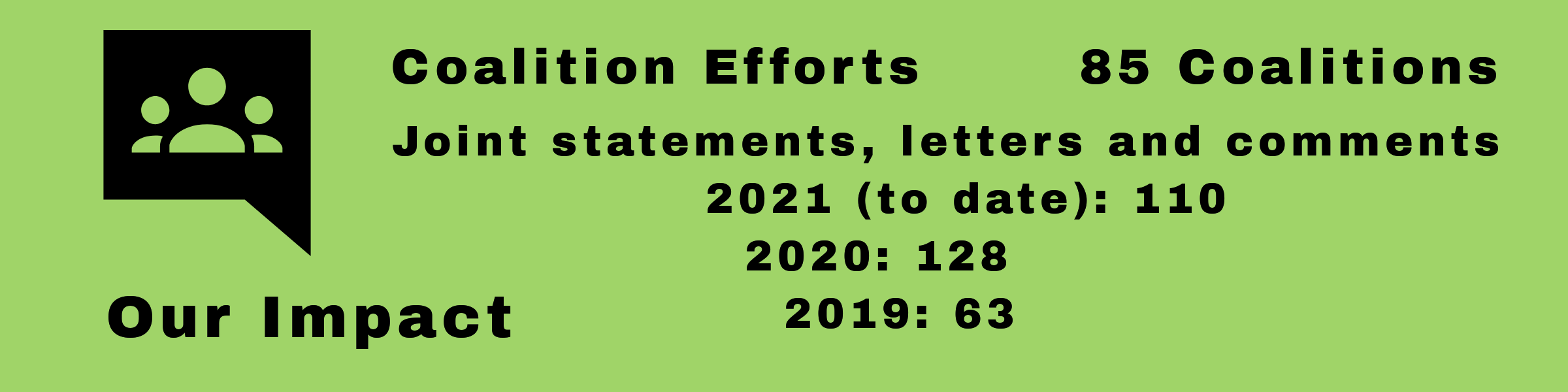

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

It’s time to dig deeper into sources of unfairness in auto insurance market

Consumer groups wrote to the Department of Treasury’s Federal Insurance Office (FIO) asking that the FIO prioritize an immediate update of its auto insurance affordability study using improved methods and conduct additional research on uninsured drivers, socioeconomic factors in auto insurance pricing, and how these factors have a disparate impact on people of color. As many families rely on automobiles to take them to school and work, it’s particularly important that auto insurance is available, affordable and priced fairly in the marketplace.

Grant FHA-backed borrowers the full forbearance relief they are legally entitled to

In a letter to the U.S. Department of Housing and Urban Development (HUD), coalition advocates urged HUD to give Federal Housing Administration-backed borrowers who start forbearance plans after July 1, 2021, access to a full 12 months of forbearance, in line with policies from the Government Sponsored Enterprises (GSEs), the Department of Veterans Affairs (VA), and the Department of Agriculture (USDA). In doing so, HUD would rightfully recognize the continued economic turmoil from the global pandemic. HUD’s current decision unnecessarily limits forbearance for borrowers accessing plans after June 30, 2021, to only six months of relief instead of the standard 12 months pursuant to the CARES Act.

More can be done to protect consumers and patients during pharmaceutical mergers

The pharmaceutical industry has become increasingly concentrated in recent years, often resulting in higher prices and reduced choice for consumers. Increasing evidence shows that consumers are paying higher prices for prescription drugs and losing out on access and choice because of less innovation by drug companies. Advocates argue that the Federal Trade Commission’s current approach to monitoring pharmaceutical mergers, and its historically pro-merger policy, fails to fully protect American consumers and patients.

Protect retirement savers from risky private equity investments

Consumer Action joined allies in a letter to the Department of Labor asking the department to ensure that “defined contribution plan fiduciaries”—those responsible for ensuring that employer-based retirement plans feature safe and appropriate investments—undertake balanced consideration of the benefits and risks before they allow private equity funds to be offered to retirees.

Choice of retirement plan disclosure notice still important for workers and retirees

Consumer Action joined coalition members in urging the Employee Benefits Security Administration and the Department of Labor to address the severe shortcomings in the Department’s recently adopted “Notice-and-Access” rule. Until the changes last May, the default had been to deliver retirement plan disclosures on paper, sent through the mail. Under the new rule, the retirement plan merely sends an email or text message to a consumer letting them know that a disclosure is available on a website. The new rule’s default makes no provision for the sizeable proportion of individuals who still don’t have access to computers or internet service and makes it much harder for ordinary Americans to access the documents they need to plan for retirement.

The FTC and CFPB must do more to prevent mass homelessness during the pandemic

Over 11 million families are at risk of losing housing. Protection from evictions and foreclosures is greatly needed due to the ongoing economic crisis accompanying the COVID-19 pandemic, including the loss of household income in the near and long term. Consumer Action joined advocates in urging the U.S. Federal Trade Commission and the Consumer Financial Protection Bureau to work together to prohibit unfair debt collections and ensure financial and regulatory agencies confirm industry standards regarding forbearance availability for homeowners. Without these additional protections, many will lose their homes and be forced to move at a time when COVID-19 levels are still extremely high and vaccination access for many is still months away. As a result, the financial impact of COVID would result in substantially greater risk of spreading illness.

Immediate action needed to help keep families in their homes

As millions of Americans face continued hardship from the COVID-19 pandemic, advocates wrote to the Consumer Financial Protection Bureau (CFPB) to urge the Bureau to keep individuals and families in their homes. Advocates recommended specific steps the Bureau can take to help borrowers avoid foreclosure, including homeowners without federally-backed mortgages. They asked that the CFPB focus on implementing quick policies during this current crisis, rather than embarking on a larger disaster-related rulemaking, leaving time to analyze best practices and measure how well the policies adopted during this crisis worked to save homes.

Advocates urge the Biden administration to slash drug costs

Advocates wrote to the Biden administration asking the President-elect to immediately implement a series of reforms to slash prescription drug costs once he takes office. Advocates urged the President-elect to authorize more generic competition through patent licensing, launch a demonstration project in Medicare to link payments to vastly lower costs paid broadly and prosecute pharmaceutical companies for anti-competitive behavior. Americans currently spend more on prescription drugs than anyone else in the world. There were 717 drug price increases so far this year, and just seven of them on generics, bumping prices up by 4.5 percent on average. It’s time to improve the lives of patients and families by lowering drug prices and making medicines affordable.

Advocates urge the Biden administration to reject Big Tech appointments to his cabinet

In a letter to President-elect Biden, consumer and privacy advocates urged the President-elect to avoid appointing representatives from tech giants like Amazon, Apple, Facebook and Google to his cabinet. These companies represent serious threats to privacy, democracy, innovation and to Americans’ economic well-being. Advocates warned that representatives from these companies should not hold positions of power within our government. Instead, advocates urged Biden to assemble a team of advocates that will represent working Americans and not the Big Tech companies that work to exploit them.

Studies show systemic racism in insurance industry

Consumer Action joined a coalition of consumer and community activists in submitting comments to the National Association of Insurance Commissioners' Special Committee on Race and Insurance urging them to focus efforts on creating tools to help states and insurers identify and combat systemic racism in insurance. Studies over many years have shown elements of racism in pricing, placement of agents, redlining and other aspects of insurance. But systemic racism is not found in just a few elements of insurance; it casts its shadow across all aspects of insurance and needs to be confronted in a systematic and holistic manner.

Quick Menu

Support Consumer Action

Join Our Email List

Insurance Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts